Term Life Insurance: Protect Your Family | Northwestern Mutual

Are you prepared to safeguard your family's financial future, even in your absence? Term life insurance offers a remarkably accessible solution, providing essential protection for a defined period, allowing you to secure your loved ones' well-being without straining your budget.

Understanding the intricacies of life insurance can feel like navigating a complex financial maze. However, the core principle is straightforward: it's a contract between you and an insurance company. You pay premiums, and in return, the insurer provides a death benefit to your designated beneficiaries if you pass away during the policy's term. This payout can be instrumental in covering crucial expenses like mortgage payments, childcare costs, educational funds, or simply maintaining their standard of living.

This article delves into the specifics of term life insurance, contrasting it with permanent life insurance options, and offering insights into how to determine the right coverage for your individual needs. We'll explore various policy features, including conversion options and riders, and provide an overview of specific offerings from leading insurers, like Northwestern Mutual. Let's begin by defining the fundamentals and exploring the benefits of this essential financial tool.

To grasp the essence of term life insurance, let's first consider how it contrasts with its counterpart, permanent life insurance. Term life insurance offers coverage for a specific timeframe, such as 10, 20, or 30 years. If you pass away within the term, your beneficiaries receive the death benefit. However, if you outlive the term, the policy expires, and there's no payout. This straightforward structure makes term life insurance generally more affordable than permanent life insurance.

Now, let's move to the table with relevant information.

| Category | Details |

|---|---|

| Product Type | Term Life Insurance |

| Description | Provides coverage for a specific period (term) at a fixed premium, ensuring financial protection for beneficiaries if the insured passes away within the term. |

| Key Features |

|

| Best For |

|

| Common Options |

|

| Conversion Options | Some term life insurance policies offer a conversion option, allowing the policyholder to convert the policy to permanent life insurance without requiring a medical exam. |

| Riders |

|

| Companies Offering Term Life Insurance |

|

| Financial Protection | Provides a death benefit, providing financial security to the insured's beneficiaries. |

| Website Reference | Investopedia |

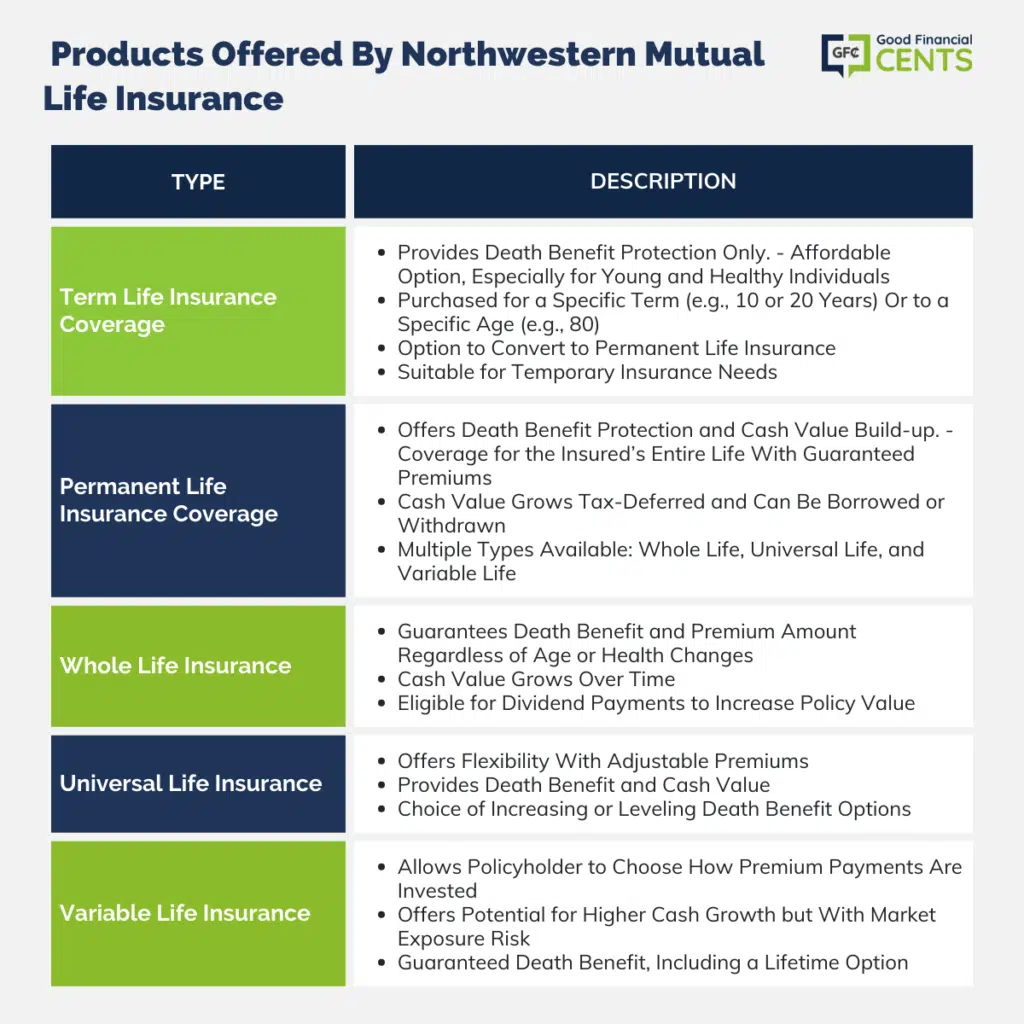

In contrast, permanent life insurance offers lifelong coverage. As long as you pay the premiums, the policy remains in effect, and your beneficiaries will receive a death benefit whenever you pass away. There are different types of permanent life insurance, including whole life, universal life, and variable universal life. Each of these options provides a death benefit and often includes a cash value component that grows over time. However, permanent life insurance policies typically have higher premiums compared to term life insurance.

- Jeffrey Glasko A Comprehensive Biography And Insights

- Everything You Need To Know About Hdtodaytv Your Ultimate Streaming Guide

When deciding between term and permanent life insurance, consider your individual circumstances and financial goals. Term life insurance is often a good choice if you have specific, temporary financial obligations, such as a mortgage or raising young children. It is generally more budget-friendly, making it easier to secure a substantial amount of coverage. On the other hand, permanent life insurance may be suitable if you need lifelong coverage, desire a cash value component for investment or retirement planning, or want to leave a legacy for your heirs. Always consider your long term goals and financial state.

Now, let's delve into the benefits and features offered by specific insurers. Northwestern Mutual is a well-established insurance company with a range of life insurance products. They offer both term and permanent life insurance options, including annual renewable term life insurance and level term life insurance. This flexibility enables you to tailor your coverage to your specific needs.

Northwestern Mutual's term life insurance policies provide coverage for a specific period, like 10, 20 years, or until you reach 80 years old. Premiums for level term policies remain constant throughout the term, providing predictable expenses. The annual renewable term option provides a lower initial premium, but it increases annually as you get older. Northwestern Mutual also offers a variety of riders that provide additional benefits, such as the ability to convert your term policy to a permanent policy without another medical exam.

It's important to understand how the cost of term life insurance is determined. The cost is primarily based on your age, health, and the amount of coverage you choose. The older you are when you purchase the policy, the higher the premiums will be. Furthermore, if you have any pre-existing health conditions, your premiums may also be higher. To get the most affordable rates, it's important to shop around and compare quotes from different insurance companies.

With term insurance, the cost you pay each year is based on your age. When youre younger, term life insurance is less expensive. But as you get older, the cost of your insurance will increase. Your coverage will end someday. Unlike permanent life insurance, which never expires, a term life insurance policy will end at some point in the future.

Another aspect to consider is the coverage amount. Determining how much life insurance you need can seem daunting, but it's crucial to ensure your beneficiaries are adequately protected. A common rule of thumb is to aim for coverage that is ten times your annual salary. However, you should also account for other factors, such as debts, the number of dependents, and future financial goals. You can also use online calculators to estimate your insurance needs based on your specific situation.

Another important detail is the importance of riders. Riders are additional features or benefits that you can add to your policy to enhance its coverage. Some common riders include accidental death benefit, which pays an additional benefit if death is due to an accident; children's term rider, which provides term life insurance coverage for your children; and waiver of premium, which waives premium payments if you become disabled. These riders can provide additional protection and peace of mind. When you are comparing policies, consider which riders might be most beneficial to your needs.

While term life insurance offers numerous advantages, it's essential to acknowledge its limitations. The coverage is temporary, so it will expire at the end of the term. If you still need coverage at that point, you'll have to renew the policy, which may result in significantly higher premiums, or you may need to purchase a new policy. As your financial obligations and priorities evolve, it's wise to review your life insurance coverage regularly to ensure it continues to meet your needs.

When evaluating insurance providers, customer service is paramount. Northwestern Mutual is known for its highly rated customer service. As a mutual insurance company, it has consistently issued cash dividend payouts to whole life insurance policyholders. This is a testament to their financial stability and commitment to policyholders. When comparing different insurance companies, make sure to consider customer ratings, financial stability, and the available range of policy options.

Group term life insurance is another option. It's an insurance policy offered to all members of a group, such as employees of a company or members of an association. Group term life insurance typically offers lower premiums than individual policies. However, the coverage amount may be limited, and the coverage usually ends when you leave the group. This may be a good option to start with, but a personal term life insurance policy is generally a better long-term solution.

Northwestern Mutual offers a range of term life insurance options, including annual renewable term life and level term life policies. Level term policies offer stable premiums for a specific period, making budgeting easier. The annual renewable term policy, on the other hand, has premiums that can increase each year. They also provide a good range of permanent life insurance options. When you're comparing policies, consider your needs, your budget, and your long-term financial goals. It is a crucial part of securing your financial well-being and protecting your loved ones.

Northwestern Mutual's term 80 product is an annual renewable term life insurance policy that lasts until the policyholder reaches 80 years of age. The premiums increase each year and can get very expensive as the insured gets older. The policy does have a conversion option, which allows the policyholder to convert their term policy to a permanent policy without having to go through another medical exam. This provides some flexibility and security. Always carefully evaluate the fine print of the policy before committing to it.

One of the significant benefits of term life insurance is its affordability. Because the coverage is for a limited time, premiums are significantly lower than those for permanent life insurance. This makes term life insurance a great choice for those on a budget. This allows you to secure a substantial amount of coverage without overspending. The savings on premiums may also free up funds for other important financial goals, such as retirement savings or debt reduction.

Another aspect to consider is the conversion options offered by the insurance company. Northwestern Mutual, for example, provides policyholders with the option to convert their term life policy into a permanent life insurance policy without providing further medical information. This can be valuable as it means the coverage does not expire. With this conversion option, as your needs evolve, you can transition to a long-term coverage solution.

Life insurance is not a one-size-fits-all product. It is always important to tailor your policy to your specific needs. The right insurance company can offer help with a diverse set of products and options. Northwestern Mutual is the marketing name for the Northwestern Mutual Life Insurance Company and its subsidiaries. The best insurance companies can provide the best solutions, such as life and disability insurance, annuities, and life insurance with long-term care benefits.

To sum up, term life insurance serves as a crucial tool to secure your financial well-being and protect your loved ones. By comprehending its key features, comparing it with permanent life insurance, and carefully evaluating your needs, you can make a well-informed choice that provides peace of mind. Northwestern Mutual offers a diverse range of options, and shopping around to compare policies from various insurers is always wise. Remember, the goal is to secure a plan that offers adequate coverage and provides long-term financial protection.

- Maximilian David Muniz The Life And Legacy Of Marc Anthonys Son

- Unveiling The Life Of Veronica Lighty A Journey Through Resilience And Advocacy

The Northwestern Mutual Life Insurance Company Review Good Financial

Northwestern Mutual Term Life Insurance Guide YouTube

🔥 Northwestern Mutual Term 80 Life Insurance Review Pros and Cons